From our friends at KCM

Move-up or Downsize

Become a First-Time Homebuyer

There are many financial and non-financial benefits to owning a home, and the most important thing is to first

decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it.

Just take a look at the cost of renting vs. buying.

Refinance

If you already own a home, you may decide you’re going to refinance. It’s one way to lock in a lower monthly payment and save more over time.

However, it also means paying upfront closing costs, too. If you want to take this route, you have to answer the question: Should I refinance my home?

Why 2020 Was a Great Year for Homeownership

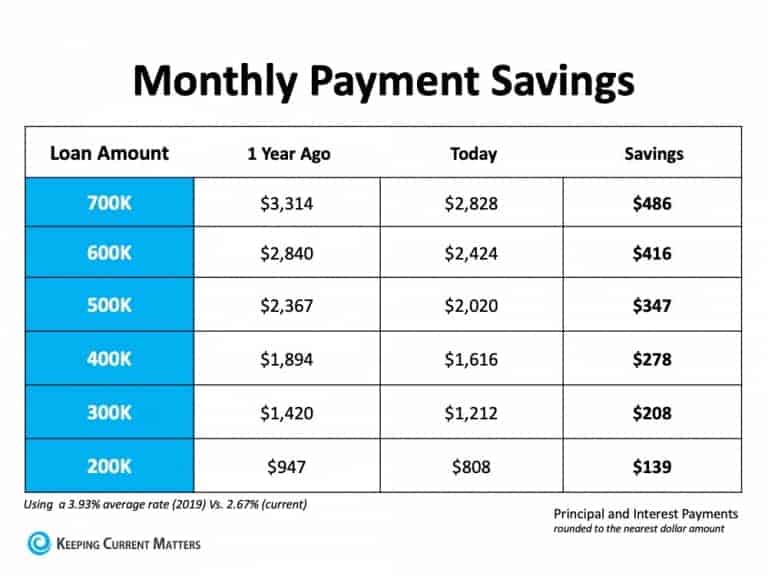

Last year, the average mortgage rate was 3.93% (substantially higher than it is today). If you waited for a better time to make a move,

Market conditions have improved significantly. Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The chart below shows how much you would save per month based on today’s rates compared to what you would have paid if you purchased a home exactly one year ago, depending on how much you finance: